Biotech 2.0

Biotech 2.0

Biotech 2.0

For the last 25+ years, we have been living through one of the greatest technological revolutions ever, the Information Age. From Web 1.0 to Web 2.0 to Mobile to Web 3.0, the best startup founders and investors have ridden these waves to impact billions of people and make billions of dollars.house, leading the world in various fields such as renewable energy, biotechnology, and artificial intelligence.

For the last 25+ years, we have been living through one of the greatest technological revolutions ever, the Information Age. From Web 1.0 to Web 2.0 to Mobile to Web 3.0, the best startup founders and investors have ridden these waves to impact billions of people and make billions of dollars.house, leading the world in various fields such as renewable energy, biotechnology, and artificial intelligence.

For the last 25+ years, we have been living through one of the greatest technological revolutions ever, the Information Age. From Web 1.0 to Web 2.0 to Mobile to Web 3.0, the best startup founders and investors have ridden these waves to impact billions of people and make billions of dollars.house, leading the world in various fields such as renewable energy, biotechnology, and artificial intelligence.

For the last 25+ years, we have been living through one of the greatest technological revolutions ever, the Information Age. From Web 1.0 to Web 2.0 to Mobile to Web 3.0, the best startup founders and investors have ridden these waves to impact billions of people and make billions of dollars.house, leading the world in various fields such as renewable energy, biotechnology, and artificial intelligence.

Biotech 2.0

Posted byNeil Thanedar

Who will fund the future of biotech?

Introduction:

In my post It’s 1994 Again, I explained how we got to Biotech 1.0:

For the last 25+ years, we have been living through one of the greatest technological revolutions ever, the Information Age. From Web 1.0 to Web 2.0 to Mobile to Web 3.0, the best startup founders and investors have ridden these waves to impact billions of people and make billions of dollars.

We are now in Biotech 1.0. Molecular biology went mainstream in 2020 with COVID virus sequencing and vaccine development done in days and treatments distributed globally in months. 10+ years ago, software was eating the world. Now biology is eating the world.

We are now entering the Y Combinator Era for Biotech. As I described in that post:

Three key developments created a booming tech seed funding market:

Tech hardware got replaced by cloud services, dropping the cost of starting a startup to <$100K.

Y Combinator was created in 2005 and has now funded over 3,000 startups.

Hundreds of institutional seed funds formed to invest before, during, and after YC.

To get to Biotech 2.0, we need to learn from Web 2.0 and prepare for the booms and busts.

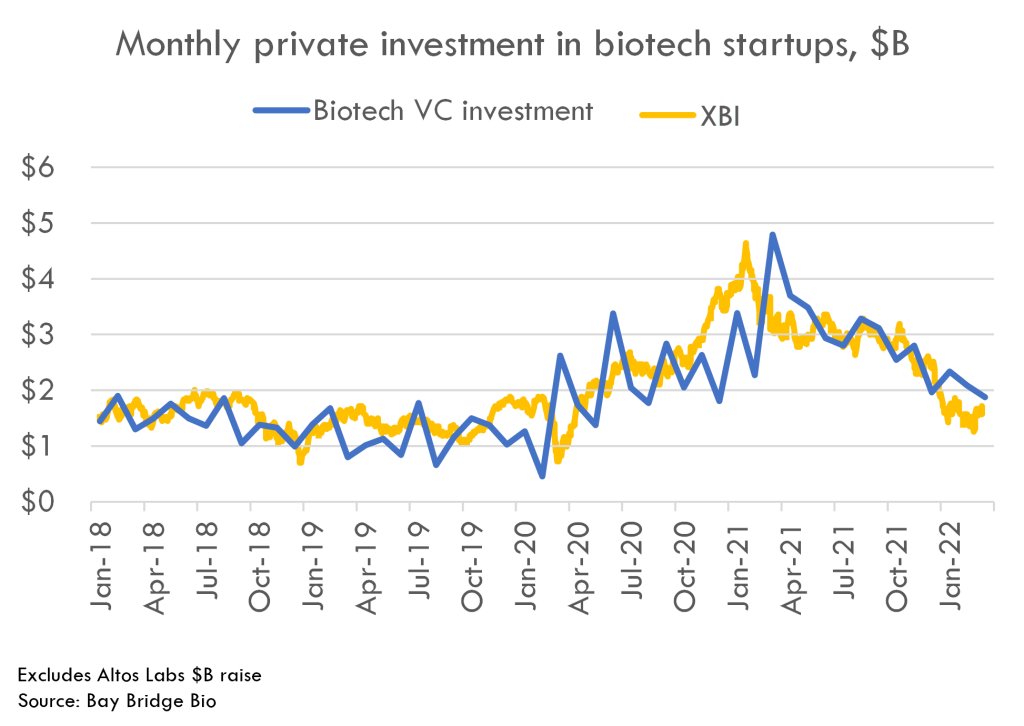

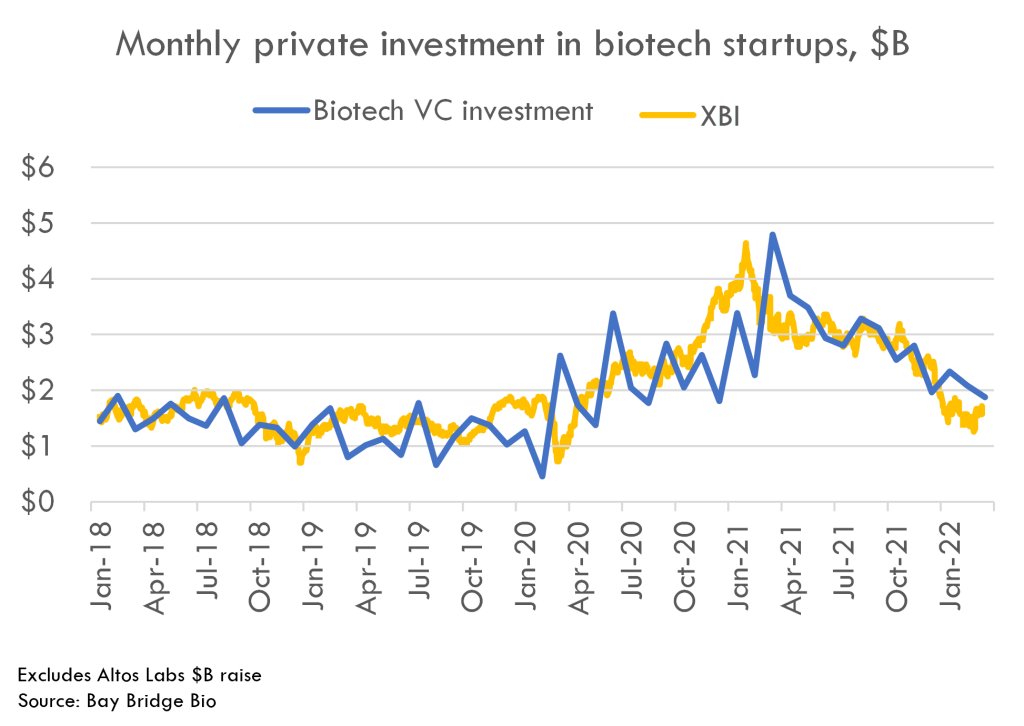

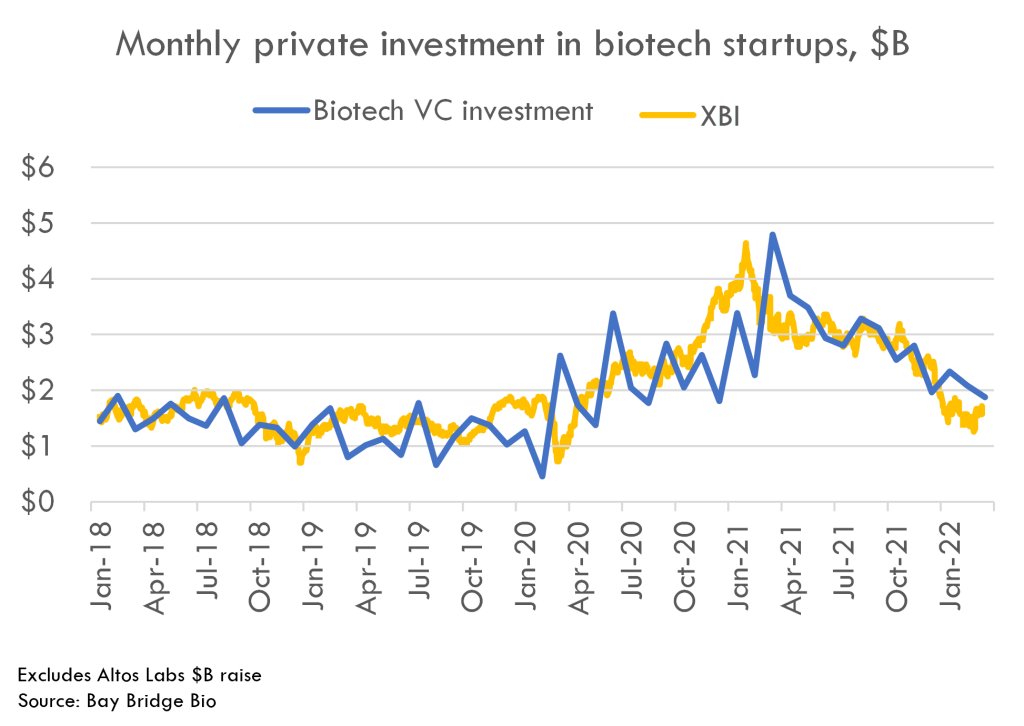

Biotech is following the same technological revolution roadmap as the internet, just 20-30 years later. The last 5 years in biotech has been a boom to bust cycle like 1996-2001 in tech. And recent biotech VC funding has been declining in step with public biotech indexes:

Source: Biotech from bust to boom — Richard Murphey, 2022

But the tech startups and investors that performed the best in the last 20+ years doubled down in recessions and rode the successive booms all the way. Now is the time for biotech startup founders and investors to start building for Biotech 2.0.

Web 1.0 vs. Biotech 1.0:

The biotech revolution has consistently been ~25 years behind the internet revolution:

ARPANET (1966) → Human Genome Project (f. 1990)

Netscape (1994) → mRNA Vaccines (2020)

Web 2.0 (1999) → Biotech 2.0 (2023)

Both revolutions started with major government projects that funded initial development and kickstarted experience curve effects.

This led to decades of exponential cost and performance improvements that transformed internet access and genetic sequencing from costing millions of dollars and taking years per customer to being essentially free and ubiquitous.

The big bang moment for tech was Netscape launching the first free, open web browser in 1994, which was the first mainstream one-to-many global application for the internet. Similarly, the COVID vaccine in 2020 was the first mainstream one-to-many global application of biotechnology.

“The relationship of Web 1.0 to the Web of tomorrow is roughly the equivalence of Pong to The Matrix. Today’s Web is essentially a prototype—a proof of concept.” Darcy DiNucci, 1999

We will look back at the COVID vaccines in the same way — as a proof of concept for the personalized vaccines that we will all be receiving in a couple decades.

Timing Biotech 2.0:

While the term Web 2.0 was first coined in 1999, it didn’t really take off until 2004-2007 when new platforms and funding became available.

We need similar breakthroughs in biotech now to get to Biotech 2.0.

Four key factors triggered the rise of web 2.0:

Growth of new social networks.

“Most importantly, who your friends are.” — Mark Zuckerberg, 2004

Creation of startup accelerators.

“Young hackers can start viable companies.” — Paul Graham, 2005.

Rise of institutional seed funds.

“$500,000 is the new $5 million.” — Mike Maples, 2006

Launch of the first iPhone.

“We’re going to make some history together today.” — Steve Jobs, 2007

The first glimmerings of Biotech 2.0 are beginning to appear.

In 1999, when Darcy DiNucci said “the first glimmerings of Web 2.0 are beginning to appear,” she used a biology analogy to describe what would happen next: “The defining trait of Web 2.0 will be that it won’t have any visible characteristics at all. The Web will be identified only by its underlying DNA structure.”

To return the analogy to biology, if Biotech 1.0 was defined by static, centralized, mass-produced, one-size-fits-all products, Biotech 2.0 will be identified by dynamic code that uses each body as a platform to create its own solutions.

After decades of research, the technology behind Biotech 2.0 is finally ready.

In the 1970s, NASA developed Technology Readiness Levels (TRL) to assess the maturity level of specific technologies:

TRL 1: Scientific research is beginning.

TRL 2: Practical applications generated from research.

TRL 3: Experimental proof of concept is constructed.

TRL 4: Small-scale prototype tested in lab.

TRL 5: Large-scale prototype tested in environment.

TRL 6: Production version tested in environment.

TRL 7: Production version tested at pre-commercial scale.

TRL 8: Production version tested at commercial scale.

TRL 9: Production is at scale.

TRL can be extremely valuable in timing investments into a space.

TRL 1-3 is largely government funded through federal programs and grants.

TRL 4-6 is funded by a spectrum of angel investors and venture capitalists.

TRL 7-9 is the domain of private equity, hedge funds, and the public markets.

Biotech 2.0 is at TRL 3 now.

This is the most exciting time for investors like me, who are looking to write the first $50K-100K checks to the most promising startups of the next decade.

If you’re an early-stage angel or VC, now is the perfect time to invest in Biotech 2.0!

Biotech 2.0’s Potential:

What happens when we can process DNA as easily as bits?

The speed of the mRNA vaccine development shows how much biotech is now driven by code:

On January 9, 2020, the novel coronavirus, 2019-nCoV, was publicly announced. By January 11th, the 29,811 nucleotide sequence of the virus was fully sequenced, and on January 13th, the 4,101 nucleotide sequence of Moderna’s mRNA active ingredient was complete.

Biotech 2.0 will leverage these speed and cost advances to enable truly personalized medicine.

In the next decade, it will be cost-effective to genetically sequence individual cancers and create personalized therapeutics.

At Biotech 2.0’s full potential, gene editing will instruct your body to create the tools for its own prolonged survival, proactively attacking harmful viruses and creating essential nutrients ourselves.

Funding Biotech 2.0:

To get the hundreds of breakthrough Biotech 2.0 innovations of our near future, we will need thousands of new biotech startups to launch this decade. Who are going to be the seed investors for all of these startups?

Now we need to create the top institutional seed funds of Biotech 2.0.

Floodgate, one of the leading institutional tech seed funds, was founded in 2006 on the idea that “$500,000 is the new $5 million.”

Web 2.0 benefited from decades of Moore’s Law effects on chip density and costs, which led to cloud and mobile advances which made it much cheaper to launch startups.

$500,000 is the new $5 million in biotech now.

With costs for key inputs like genome sequencing and cell programming falling faster than Moore’s Law for decades, we’re nearing the conditions for Biotech 2.0.

As both biological targets and therapeutics can increasingly be modeled entirely with software and manipulated with AI, scientists can launch biotech startups essentially for free with AWS credits.

Also, contract research and academic research organizations (CROs and AROs) have become more startup friendly, allowing biotech startups to scale up costs over time instead of building a lab up-front.

Opportunity #1: Bring the original Y Combinator model to biotech.

We are about to enter the next financial frenzy for biotech startups.

But there is still a funding gap to invest the first $50K-100K for scientist CEOs to create the initial proof of concepts that will earn those top seed investments and beyond.

I’m building Utopic to be the first angel/pre-seed investor for biotech startups.

Opportunity #2: Create the SV Angel/First Round/Floodgate of biotech.

YC and IndieBio now write $500K checks for seed-stage biotech startups and institutional VC funds like a16z and Lux make seed to growth stage biotech investments.

We still need more biotech seed funds leading $500K-$5M rounds.

Summary:

Web 1.0 : Biotech 1.0 :: Web 2.0 : Biotech 2.0

If Web 1.0 was one-to-many, Web 2.0 was many-to-many. Similarly, if Biotech 1.0 created one-to-many products and technologies, Biotech 2.0 will use our own bodies and other biosystems as platforms to create many-to-many pharmaceutical, agricultural, and industrial solutions.

The networks, accelerators, funds, and platforms that lead Biotech 2.0 will create trillions of dollars in value.

Web 2.0 thrived because it had networks like Facebook, accelerators like Y Combinator, funds like a16z and Floodgate, and platforms like iOS and Android.

I’m actively writing and investing in this space to jumpstart startup interest for Biotech 2.0 now. We need many more founders and investors to build every part of Biotech 2.0!

It’s been 24 years since Web 2.0 was created. It’s now time for Biotech 2.0!

If you’re innovating at the edge of Biotech 2.0, check out Utopic Ventures!

This is Part 4 in a series of essays comparing the new biotech revolution to the current tech revolution.

Part 1 is titled “It’s 1994 Again”, explaining how we are now in the dot-com era for biotech.

Part 2 is titled “YC for Biotech”, on bringing the original Y Combinator model to biotech.

Part 3 is titled “Scientist CEOs”, arguing why scientists should run their own companies.

Part 5 will be titled “The Next Genentech”, on the search for the next great biotech company.

Biotech 2.0

Posted byNeil Thanedar

Who will fund the future of biotech?

Introduction:

In my post It’s 1994 Again, I explained how we got to Biotech 1.0:

For the last 25+ years, we have been living through one of the greatest technological revolutions ever, the Information Age. From Web 1.0 to Web 2.0 to Mobile to Web 3.0, the best startup founders and investors have ridden these waves to impact billions of people and make billions of dollars.

We are now in Biotech 1.0. Molecular biology went mainstream in 2020 with COVID virus sequencing and vaccine development done in days and treatments distributed globally in months. 10+ years ago, software was eating the world. Now biology is eating the world.

We are now entering the Y Combinator Era for Biotech. As I described in that post:

Three key developments created a booming tech seed funding market:

Tech hardware got replaced by cloud services, dropping the cost of starting a startup to <$100K.

Y Combinator was created in 2005 and has now funded over 3,000 startups.

Hundreds of institutional seed funds formed to invest before, during, and after YC.

To get to Biotech 2.0, we need to learn from Web 2.0 and prepare for the booms and busts.

Biotech is following the same technological revolution roadmap as the internet, just 20-30 years later. The last 5 years in biotech has been a boom to bust cycle like 1996-2001 in tech. And recent biotech VC funding has been declining in step with public biotech indexes:

Source: Biotech from bust to boom — Richard Murphey, 2022

But the tech startups and investors that performed the best in the last 20+ years doubled down in recessions and rode the successive booms all the way. Now is the time for biotech startup founders and investors to start building for Biotech 2.0.

Web 1.0 vs. Biotech 1.0:

The biotech revolution has consistently been ~25 years behind the internet revolution:

ARPANET (1966) → Human Genome Project (f. 1990)

Netscape (1994) → mRNA Vaccines (2020)

Web 2.0 (1999) → Biotech 2.0 (2023)

Both revolutions started with major government projects that funded initial development and kickstarted experience curve effects.

This led to decades of exponential cost and performance improvements that transformed internet access and genetic sequencing from costing millions of dollars and taking years per customer to being essentially free and ubiquitous.

The big bang moment for tech was Netscape launching the first free, open web browser in 1994, which was the first mainstream one-to-many global application for the internet. Similarly, the COVID vaccine in 2020 was the first mainstream one-to-many global application of biotechnology.

“The relationship of Web 1.0 to the Web of tomorrow is roughly the equivalence of Pong to The Matrix. Today’s Web is essentially a prototype—a proof of concept.” Darcy DiNucci, 1999

We will look back at the COVID vaccines in the same way — as a proof of concept for the personalized vaccines that we will all be receiving in a couple decades.

Timing Biotech 2.0:

While the term Web 2.0 was first coined in 1999, it didn’t really take off until 2004-2007 when new platforms and funding became available.

We need similar breakthroughs in biotech now to get to Biotech 2.0.

Four key factors triggered the rise of web 2.0:

Growth of new social networks.

“Most importantly, who your friends are.” — Mark Zuckerberg, 2004

Creation of startup accelerators.

“Young hackers can start viable companies.” — Paul Graham, 2005.

Rise of institutional seed funds.

“$500,000 is the new $5 million.” — Mike Maples, 2006

Launch of the first iPhone.

“We’re going to make some history together today.” — Steve Jobs, 2007

The first glimmerings of Biotech 2.0 are beginning to appear.

In 1999, when Darcy DiNucci said “the first glimmerings of Web 2.0 are beginning to appear,” she used a biology analogy to describe what would happen next: “The defining trait of Web 2.0 will be that it won’t have any visible characteristics at all. The Web will be identified only by its underlying DNA structure.”

To return the analogy to biology, if Biotech 1.0 was defined by static, centralized, mass-produced, one-size-fits-all products, Biotech 2.0 will be identified by dynamic code that uses each body as a platform to create its own solutions.

After decades of research, the technology behind Biotech 2.0 is finally ready.

In the 1970s, NASA developed Technology Readiness Levels (TRL) to assess the maturity level of specific technologies:

TRL 1: Scientific research is beginning.

TRL 2: Practical applications generated from research.

TRL 3: Experimental proof of concept is constructed.

TRL 4: Small-scale prototype tested in lab.

TRL 5: Large-scale prototype tested in environment.

TRL 6: Production version tested in environment.

TRL 7: Production version tested at pre-commercial scale.

TRL 8: Production version tested at commercial scale.

TRL 9: Production is at scale.

TRL can be extremely valuable in timing investments into a space.

TRL 1-3 is largely government funded through federal programs and grants.

TRL 4-6 is funded by a spectrum of angel investors and venture capitalists.

TRL 7-9 is the domain of private equity, hedge funds, and the public markets.

Biotech 2.0 is at TRL 3 now.

This is the most exciting time for investors like me, who are looking to write the first $50K-100K checks to the most promising startups of the next decade.

If you’re an early-stage angel or VC, now is the perfect time to invest in Biotech 2.0!

Biotech 2.0’s Potential:

What happens when we can process DNA as easily as bits?

The speed of the mRNA vaccine development shows how much biotech is now driven by code:

On January 9, 2020, the novel coronavirus, 2019-nCoV, was publicly announced. By January 11th, the 29,811 nucleotide sequence of the virus was fully sequenced, and on January 13th, the 4,101 nucleotide sequence of Moderna’s mRNA active ingredient was complete.

Biotech 2.0 will leverage these speed and cost advances to enable truly personalized medicine.

In the next decade, it will be cost-effective to genetically sequence individual cancers and create personalized therapeutics.

At Biotech 2.0’s full potential, gene editing will instruct your body to create the tools for its own prolonged survival, proactively attacking harmful viruses and creating essential nutrients ourselves.

Funding Biotech 2.0:

To get the hundreds of breakthrough Biotech 2.0 innovations of our near future, we will need thousands of new biotech startups to launch this decade. Who are going to be the seed investors for all of these startups?

Now we need to create the top institutional seed funds of Biotech 2.0.

Floodgate, one of the leading institutional tech seed funds, was founded in 2006 on the idea that “$500,000 is the new $5 million.”

Web 2.0 benefited from decades of Moore’s Law effects on chip density and costs, which led to cloud and mobile advances which made it much cheaper to launch startups.

$500,000 is the new $5 million in biotech now.

With costs for key inputs like genome sequencing and cell programming falling faster than Moore’s Law for decades, we’re nearing the conditions for Biotech 2.0.

As both biological targets and therapeutics can increasingly be modeled entirely with software and manipulated with AI, scientists can launch biotech startups essentially for free with AWS credits.

Also, contract research and academic research organizations (CROs and AROs) have become more startup friendly, allowing biotech startups to scale up costs over time instead of building a lab up-front.

Opportunity #1: Bring the original Y Combinator model to biotech.

We are about to enter the next financial frenzy for biotech startups.

But there is still a funding gap to invest the first $50K-100K for scientist CEOs to create the initial proof of concepts that will earn those top seed investments and beyond.

I’m building Utopic to be the first angel/pre-seed investor for biotech startups.

Opportunity #2: Create the SV Angel/First Round/Floodgate of biotech.

YC and IndieBio now write $500K checks for seed-stage biotech startups and institutional VC funds like a16z and Lux make seed to growth stage biotech investments.

We still need more biotech seed funds leading $500K-$5M rounds.

Summary:

Web 1.0 : Biotech 1.0 :: Web 2.0 : Biotech 2.0

If Web 1.0 was one-to-many, Web 2.0 was many-to-many. Similarly, if Biotech 1.0 created one-to-many products and technologies, Biotech 2.0 will use our own bodies and other biosystems as platforms to create many-to-many pharmaceutical, agricultural, and industrial solutions.

The networks, accelerators, funds, and platforms that lead Biotech 2.0 will create trillions of dollars in value.

Web 2.0 thrived because it had networks like Facebook, accelerators like Y Combinator, funds like a16z and Floodgate, and platforms like iOS and Android.

I’m actively writing and investing in this space to jumpstart startup interest for Biotech 2.0 now. We need many more founders and investors to build every part of Biotech 2.0!

It’s been 24 years since Web 2.0 was created. It’s now time for Biotech 2.0!

If you’re innovating at the edge of Biotech 2.0, check out Utopic Ventures!

This is Part 4 in a series of essays comparing the new biotech revolution to the current tech revolution.

Part 1 is titled “It’s 1994 Again”, explaining how we are now in the dot-com era for biotech.

Part 2 is titled “YC for Biotech”, on bringing the original Y Combinator model to biotech.

Part 3 is titled “Scientist CEOs”, arguing why scientists should run their own companies.

Part 5 will be titled “The Next Genentech”, on the search for the next great biotech company.

Biotech 2.0

Posted byNeil Thanedar

Who will fund the future of biotech?

Introduction:

In my post It’s 1994 Again, I explained how we got to Biotech 1.0:

For the last 25+ years, we have been living through one of the greatest technological revolutions ever, the Information Age. From Web 1.0 to Web 2.0 to Mobile to Web 3.0, the best startup founders and investors have ridden these waves to impact billions of people and make billions of dollars.

We are now in Biotech 1.0. Molecular biology went mainstream in 2020 with COVID virus sequencing and vaccine development done in days and treatments distributed globally in months. 10+ years ago, software was eating the world. Now biology is eating the world.

We are now entering the Y Combinator Era for Biotech. As I described in that post:

Three key developments created a booming tech seed funding market:

Tech hardware got replaced by cloud services, dropping the cost of starting a startup to <$100K.

Y Combinator was created in 2005 and has now funded over 3,000 startups.

Hundreds of institutional seed funds formed to invest before, during, and after YC.

To get to Biotech 2.0, we need to learn from Web 2.0 and prepare for the booms and busts.

Biotech is following the same technological revolution roadmap as the internet, just 20-30 years later. The last 5 years in biotech has been a boom to bust cycle like 1996-2001 in tech. And recent biotech VC funding has been declining in step with public biotech indexes:

Source: Biotech from bust to boom — Richard Murphey, 2022

But the tech startups and investors that performed the best in the last 20+ years doubled down in recessions and rode the successive booms all the way. Now is the time for biotech startup founders and investors to start building for Biotech 2.0.

Web 1.0 vs. Biotech 1.0:

The biotech revolution has consistently been ~25 years behind the internet revolution:

ARPANET (1966) → Human Genome Project (f. 1990)

Netscape (1994) → mRNA Vaccines (2020)

Web 2.0 (1999) → Biotech 2.0 (2023)

Both revolutions started with major government projects that funded initial development and kickstarted experience curve effects.

This led to decades of exponential cost and performance improvements that transformed internet access and genetic sequencing from costing millions of dollars and taking years per customer to being essentially free and ubiquitous.

The big bang moment for tech was Netscape launching the first free, open web browser in 1994, which was the first mainstream one-to-many global application for the internet. Similarly, the COVID vaccine in 2020 was the first mainstream one-to-many global application of biotechnology.

“The relationship of Web 1.0 to the Web of tomorrow is roughly the equivalence of Pong to The Matrix. Today’s Web is essentially a prototype—a proof of concept.” Darcy DiNucci, 1999

We will look back at the COVID vaccines in the same way — as a proof of concept for the personalized vaccines that we will all be receiving in a couple decades.

Timing Biotech 2.0:

While the term Web 2.0 was first coined in 1999, it didn’t really take off until 2004-2007 when new platforms and funding became available.

We need similar breakthroughs in biotech now to get to Biotech 2.0.

Four key factors triggered the rise of web 2.0:

Growth of new social networks.

“Most importantly, who your friends are.” — Mark Zuckerberg, 2004

Creation of startup accelerators.

“Young hackers can start viable companies.” — Paul Graham, 2005.

Rise of institutional seed funds.

“$500,000 is the new $5 million.” — Mike Maples, 2006

Launch of the first iPhone.

“We’re going to make some history together today.” — Steve Jobs, 2007

The first glimmerings of Biotech 2.0 are beginning to appear.

In 1999, when Darcy DiNucci said “the first glimmerings of Web 2.0 are beginning to appear,” she used a biology analogy to describe what would happen next: “The defining trait of Web 2.0 will be that it won’t have any visible characteristics at all. The Web will be identified only by its underlying DNA structure.”

To return the analogy to biology, if Biotech 1.0 was defined by static, centralized, mass-produced, one-size-fits-all products, Biotech 2.0 will be identified by dynamic code that uses each body as a platform to create its own solutions.

After decades of research, the technology behind Biotech 2.0 is finally ready.

In the 1970s, NASA developed Technology Readiness Levels (TRL) to assess the maturity level of specific technologies:

TRL 1: Scientific research is beginning.

TRL 2: Practical applications generated from research.

TRL 3: Experimental proof of concept is constructed.

TRL 4: Small-scale prototype tested in lab.

TRL 5: Large-scale prototype tested in environment.

TRL 6: Production version tested in environment.

TRL 7: Production version tested at pre-commercial scale.

TRL 8: Production version tested at commercial scale.

TRL 9: Production is at scale.

TRL can be extremely valuable in timing investments into a space.

TRL 1-3 is largely government funded through federal programs and grants.

TRL 4-6 is funded by a spectrum of angel investors and venture capitalists.

TRL 7-9 is the domain of private equity, hedge funds, and the public markets.

Biotech 2.0 is at TRL 3 now.

This is the most exciting time for investors like me, who are looking to write the first $50K-100K checks to the most promising startups of the next decade.

If you’re an early-stage angel or VC, now is the perfect time to invest in Biotech 2.0!

Biotech 2.0’s Potential:

What happens when we can process DNA as easily as bits?

The speed of the mRNA vaccine development shows how much biotech is now driven by code:

On January 9, 2020, the novel coronavirus, 2019-nCoV, was publicly announced. By January 11th, the 29,811 nucleotide sequence of the virus was fully sequenced, and on January 13th, the 4,101 nucleotide sequence of Moderna’s mRNA active ingredient was complete.

Biotech 2.0 will leverage these speed and cost advances to enable truly personalized medicine.

In the next decade, it will be cost-effective to genetically sequence individual cancers and create personalized therapeutics.

At Biotech 2.0’s full potential, gene editing will instruct your body to create the tools for its own prolonged survival, proactively attacking harmful viruses and creating essential nutrients ourselves.

Funding Biotech 2.0:

To get the hundreds of breakthrough Biotech 2.0 innovations of our near future, we will need thousands of new biotech startups to launch this decade. Who are going to be the seed investors for all of these startups?

Now we need to create the top institutional seed funds of Biotech 2.0.

Floodgate, one of the leading institutional tech seed funds, was founded in 2006 on the idea that “$500,000 is the new $5 million.”

Web 2.0 benefited from decades of Moore’s Law effects on chip density and costs, which led to cloud and mobile advances which made it much cheaper to launch startups.

$500,000 is the new $5 million in biotech now.

With costs for key inputs like genome sequencing and cell programming falling faster than Moore’s Law for decades, we’re nearing the conditions for Biotech 2.0.

As both biological targets and therapeutics can increasingly be modeled entirely with software and manipulated with AI, scientists can launch biotech startups essentially for free with AWS credits.

Also, contract research and academic research organizations (CROs and AROs) have become more startup friendly, allowing biotech startups to scale up costs over time instead of building a lab up-front.

Opportunity #1: Bring the original Y Combinator model to biotech.

We are about to enter the next financial frenzy for biotech startups.

But there is still a funding gap to invest the first $50K-100K for scientist CEOs to create the initial proof of concepts that will earn those top seed investments and beyond.

I’m building Utopic to be the first angel/pre-seed investor for biotech startups.

Opportunity #2: Create the SV Angel/First Round/Floodgate of biotech.

YC and IndieBio now write $500K checks for seed-stage biotech startups and institutional VC funds like a16z and Lux make seed to growth stage biotech investments.

We still need more biotech seed funds leading $500K-$5M rounds.

Summary:

Web 1.0 : Biotech 1.0 :: Web 2.0 : Biotech 2.0

If Web 1.0 was one-to-many, Web 2.0 was many-to-many. Similarly, if Biotech 1.0 created one-to-many products and technologies, Biotech 2.0 will use our own bodies and other biosystems as platforms to create many-to-many pharmaceutical, agricultural, and industrial solutions.

The networks, accelerators, funds, and platforms that lead Biotech 2.0 will create trillions of dollars in value.

Web 2.0 thrived because it had networks like Facebook, accelerators like Y Combinator, funds like a16z and Floodgate, and platforms like iOS and Android.

I’m actively writing and investing in this space to jumpstart startup interest for Biotech 2.0 now. We need many more founders and investors to build every part of Biotech 2.0!

It’s been 24 years since Web 2.0 was created. It’s now time for Biotech 2.0!

If you’re innovating at the edge of Biotech 2.0, check out Utopic Ventures!

This is Part 4 in a series of essays comparing the new biotech revolution to the current tech revolution.

Part 1 is titled “It’s 1994 Again”, explaining how we are now in the dot-com era for biotech.

Part 2 is titled “YC for Biotech”, on bringing the original Y Combinator model to biotech.

Part 3 is titled “Scientist CEOs”, arguing why scientists should run their own companies.

Part 5 will be titled “The Next Genentech”, on the search for the next great biotech company.

For forward-thinking industry leaders,

founders, corporations, and governments.

Let's work together.

For forward-thinking industry leaders,

founders, corporations, and governments.

Let's work together.