Y Combinator for Biotech

Y Combinator for Biotech

Y Combinator for Biotech

In the realm of venture capital, the biotech industry has long been dominated by two prevailing models: Venture Incubators, such as Flagship Pioneering, and Institutional VC Funds, including NEA and OrbiMed. These models traditionally adhered to a playbook where biopharma companies raised substantial amounts of capital, built extensive infrastructure, and navigated a costly and time-consuming regulatory approval process. However, the landscape of biotech is rapidly evolving, and a new playbook is emerging—one that mirrors the Y Combinator (YC) fundraising model. In this article, we explore the potential for this model to transform the biotech sector, create more opportunities for scientist-founders, and address critical issues in the industry

In the realm of venture capital, the biotech industry has long been dominated by two prevailing models: Venture Incubators, such as Flagship Pioneering, and Institutional VC Funds, including NEA and OrbiMed. These models traditionally adhered to a playbook where biopharma companies raised substantial amounts of capital, built extensive infrastructure, and navigated a costly and time-consuming regulatory approval process. However, the landscape of biotech is rapidly evolving, and a new playbook is emerging—one that mirrors the Y Combinator (YC) fundraising model. In this article, we explore the potential for this model to transform the biotech sector, create more opportunities for scientist-founders, and address critical issues in the industry

In the realm of venture capital, the biotech industry has long been dominated by two prevailing models: Venture Incubators, such as Flagship Pioneering, and Institutional VC Funds, including NEA and OrbiMed. These models traditionally adhered to a playbook where biopharma companies raised substantial amounts of capital, built extensive infrastructure, and navigated a costly and time-consuming regulatory approval process. However, the landscape of biotech is rapidly evolving, and a new playbook is emerging—one that mirrors the Y Combinator (YC) fundraising model. In this article, we explore the potential for this model to transform the biotech sector, create more opportunities for scientist-founders, and address critical issues in the industry

In the realm of venture capital, the biotech industry has long been dominated by two prevailing models: Venture Incubators, such as Flagship Pioneering, and Institutional VC Funds, including NEA and OrbiMed. These models traditionally adhered to a playbook where biopharma companies raised substantial amounts of capital, built extensive infrastructure, and navigated a costly and time-consuming regulatory approval process. However, the landscape of biotech is rapidly evolving, and a new playbook is emerging—one that mirrors the Y Combinator (YC) fundraising model. In this article, we explore the potential for this model to transform the biotech sector, create more opportunities for scientist-founders, and address critical issues in the industry

Posted byNeil Thanedar

Bringing the original YC model to biotech.

Introduction:

Right now, there are two dominant models in biotech VC:

Venture Incubators (e.g. Flagship Pioneering – $14B AUM): VCs who create startups like Moderna “in-house”, choose the ideas, and license or build the technology themselves.

Institutional VC Funds (e.g. NEA – $25B AUM, OrbiMed – $21B AUM): VCs who invest in the biggest biotech Series A, B, and C+ rounds.

Both of these VC models are built for the old playbook for biopharma company formation:

Raise $10M+ to set up a lab, team, and infrastructure.

Hire experienced executives with PhDs, MDs, and/or MBAs to run the company.

Raise $100M+ to get through regulatory approval.

Two big changes have made it much cheaper to launch and scale biotech companies:

l.Biotech startups can now create working prototypes for less than $100K.

New industrial, chemical, and climate biotech applications often don’t require regulatory approva

The new playbook for biotech will be the YC fundraising model, as explained by Paul Graham:

“get started with a few tens of thousands from something like Y Combinator or individual angels…

raise a few hundred thousand to a few million to build the company…

once the company is clearly succeeding, raise one or more later rounds to accelerate growth.”

Biotech is stuck on Steps 1 and 2 right now. This means that only biotech founders who can skip to Step 3, usually experienced executives with previous exits, are getting funded.

Scientist-led biotech startups like Ginkgo Bioworks, Recursion, AbCellera, and Solugen continue to demonstrate that scientists-turned-founders can lead multi-billion-dollar startups.

We need more angels and VCs writing pre-seed checks to biotech startups. Bringing the YC model to biotech will lead to the creation of many more biotech startups led by their scientist founder/CEOs.

Problems:

1. The balance of power in biotech still favors investors over founders.

The median biotech company raises $44M Series A at a $83M valuation (57% ownership for VCs).

The median tech company raises $15M Series A at a $65M valuation (23% ownership for VCs).

2. There are not enough pre-seed and seed biotech VC investors. This is forcing scientific founders to rely on time-consuming academic and government grants for their first $10K-1M+ in funding.

3. Biotech VCs are biased against younger and first-time founders. When fundraising is so key to startup success, VCs select for that skill over scientific brilliance.

4. Biotech startups are raising too much money too early. Verily, Calico, and Grail, the three biggest biotech startups this decade with billions in funding each, have each struggled to commercialize any major life-saving technologies. More funding does not equal more, bigger, or faster results.

Solutions:

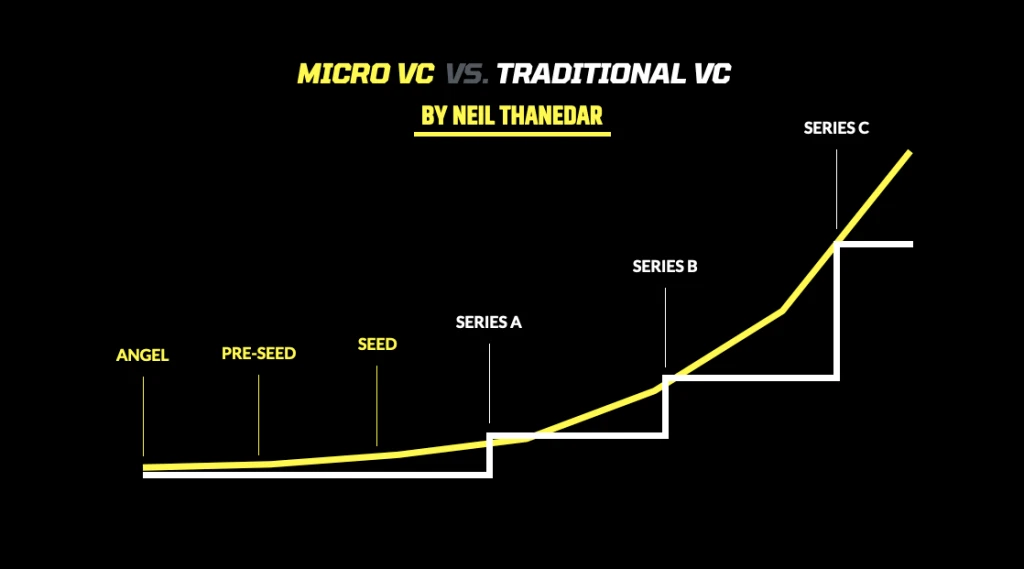

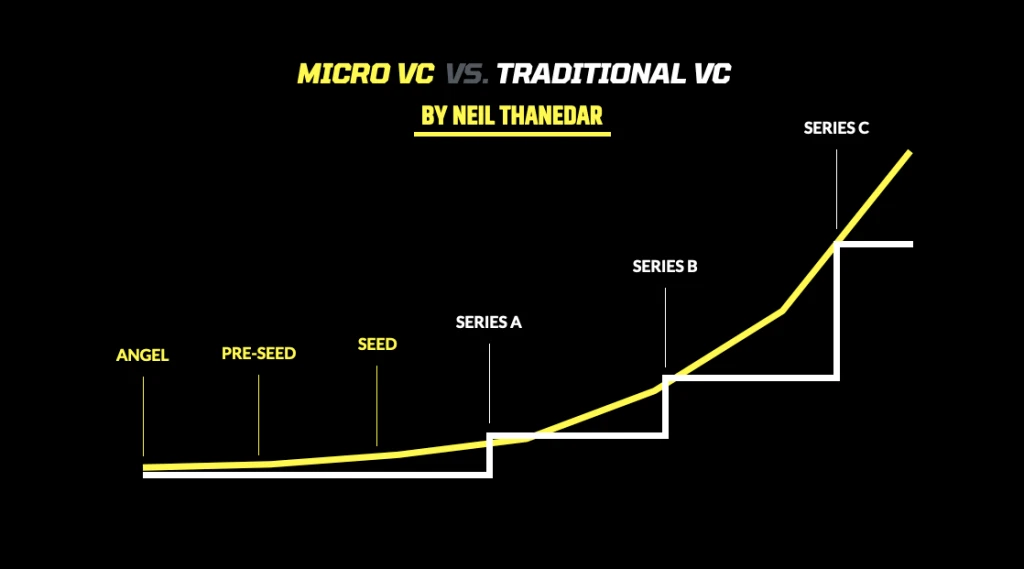

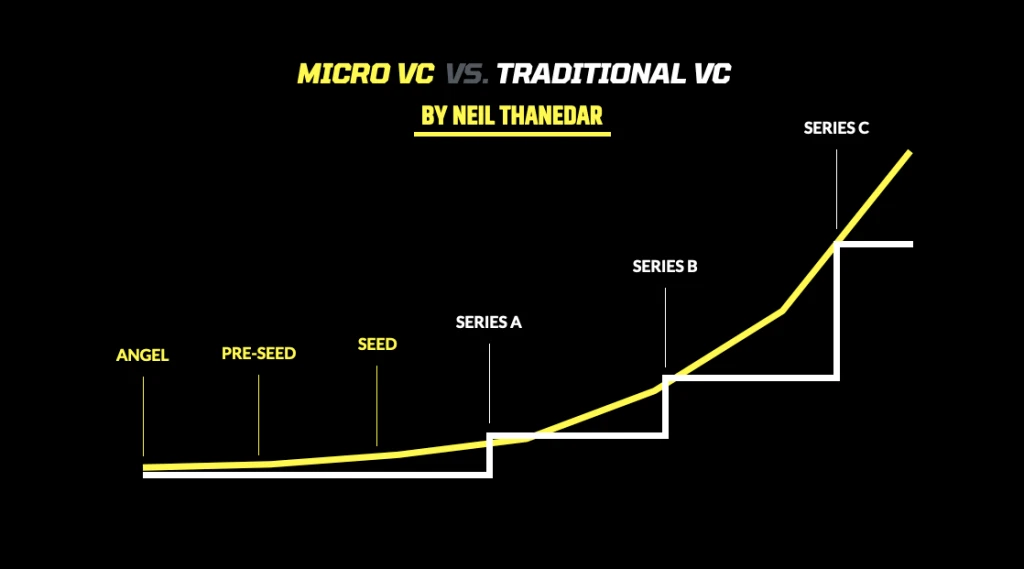

1. We need to bring the YC fundraising model to biotech. Here are the key steps:

Angel: $50K+ to start the company.

Pre-Seed: $250K+ to create prototype(s).

Seed: $1M+ to scale to production.

Series A: $5M+ to ramp up capacity.

2. We need more angels and micro VC funds in biotech. Three types of investors will fill this gap:

New pre-seed biotech VC funds will launch.

Seed and Series A biotech VCs will move earlier.

Generalist angels and pre-seed VCs will focus more on biotech.

3. Biotech VCs need to invest in more young scientific CEOs. Bob Swanson, founding CEO of Genentech, and Michael Riordan, founding CEO of Gilead, were both 29 years old when they started their companies. Both companies now do $20B+ a year in revenues and are each worth $100B+.

4. Biotech startups need to operate like YC companies. The YC fundraising model requires founders to hit more milestones faster so they can raise money more frequently on better terms. This helps biotech founders keep control of their companies and focuses startups on consistently delivering results.

History:

VCs in Silicon Valley used to operate like biotech VCs do now. 20+ years ago, it cost $5M+ to buy and operate a tech company’s hardware. So the first funding round was usually a $5M+ Series A where VCs controlled the board and had the right to fire founders.

Three key developments created a booming tech seed funding market:

Tech hardware got replaced by cloud services, dropping the cost of starting a startup to <$100K.

Y Combinator was created in 2005 and has now funded over 3,000 startups.

Hundreds of institutional seed funds formed to invest before, during, and after YC.

This led to a revolution in how tech founders fundraise for and operate their startups. Because founders could raise from YC and seed funds, they didn’t have to give up control to VCs at Series A.

Founder control is now standard in Silicon Valley. Y Combinator’s top companies Stripe, Airbnb, Doordash, Coinbase, and Dropbox are all still run by their founding CEO.

Trends:

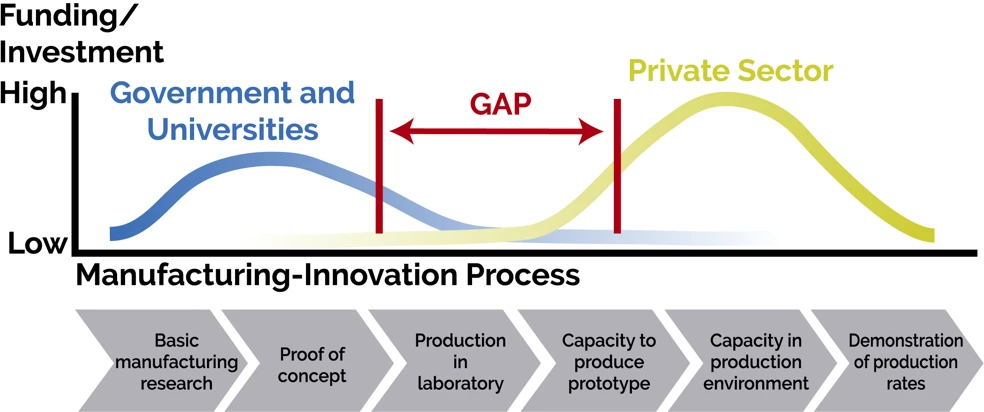

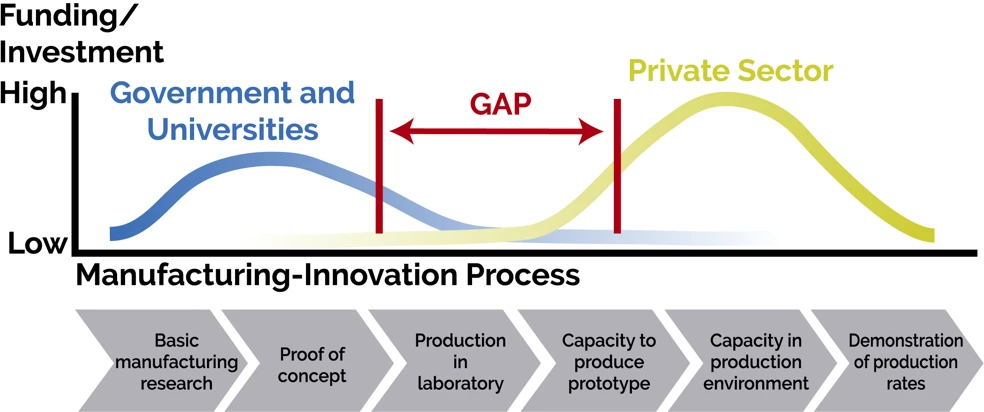

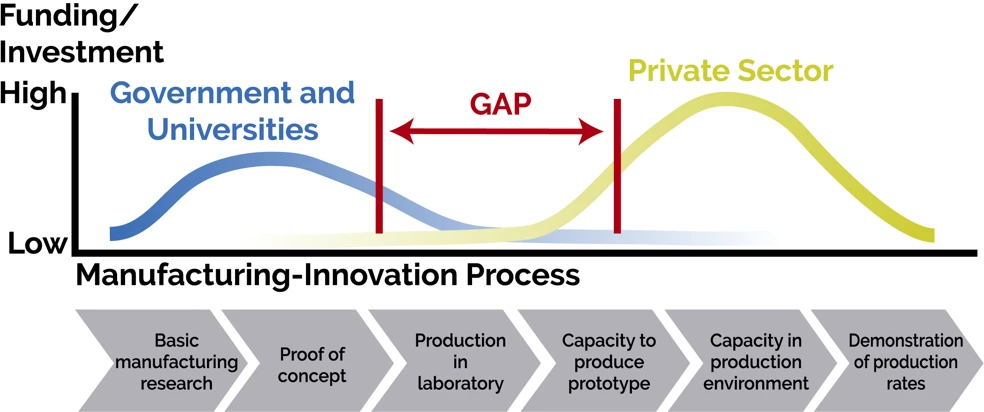

1. There is a funding gap for pre-seed scientific startups.

Over 75% of all life sciences funding is distributed via academic and/or government grants.

Another 20%+ ($15B per year) is invested by institutional VCs, PEs, and corporates.

This leaves less than $3B per year in seed funding (<5%) for all biotech + medtech startups.

Source: Bridging the ‘Valley of Death’ for U.S. Biomanufacturing

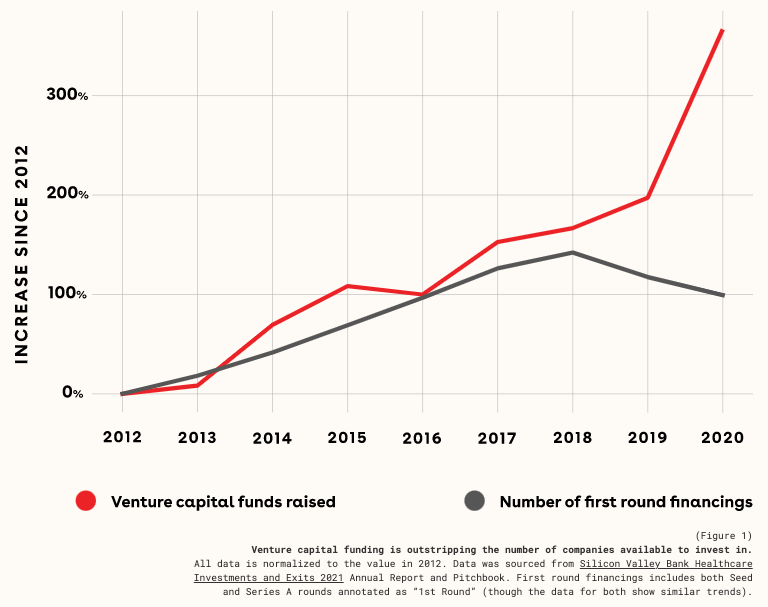

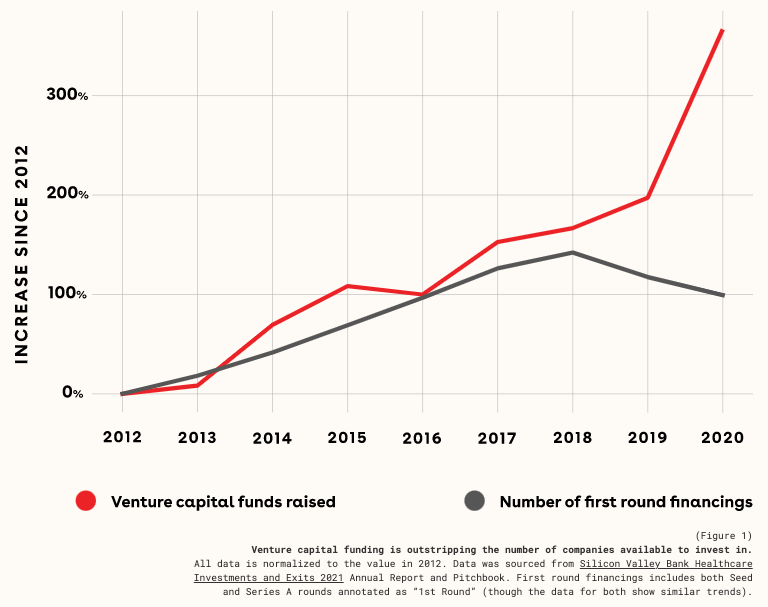

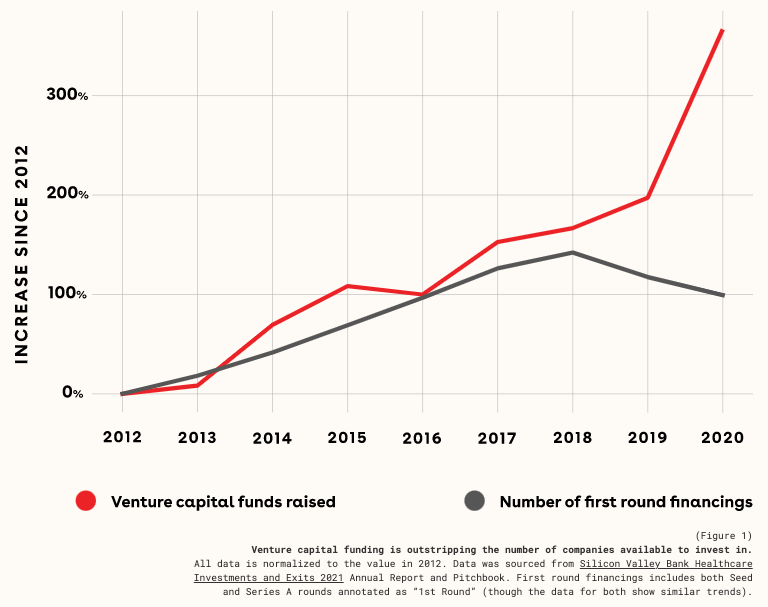

2. More venture capital funds are flowing to fewer companies.

This trend is driven by increasing VC fund sizes.

VC assets under management (AUM) has grown 5X+ (20.2% CAGR) since 2012.

The total number of active US VC funds only grew from 750 to 1,000 since 2010.

This dynamic leads to higher fees but lower returns.

VC fund models show that larger portfolios outperform smaller ones from 10 to 1000 startups.

Source: The Future of Biotech is Founder-Led

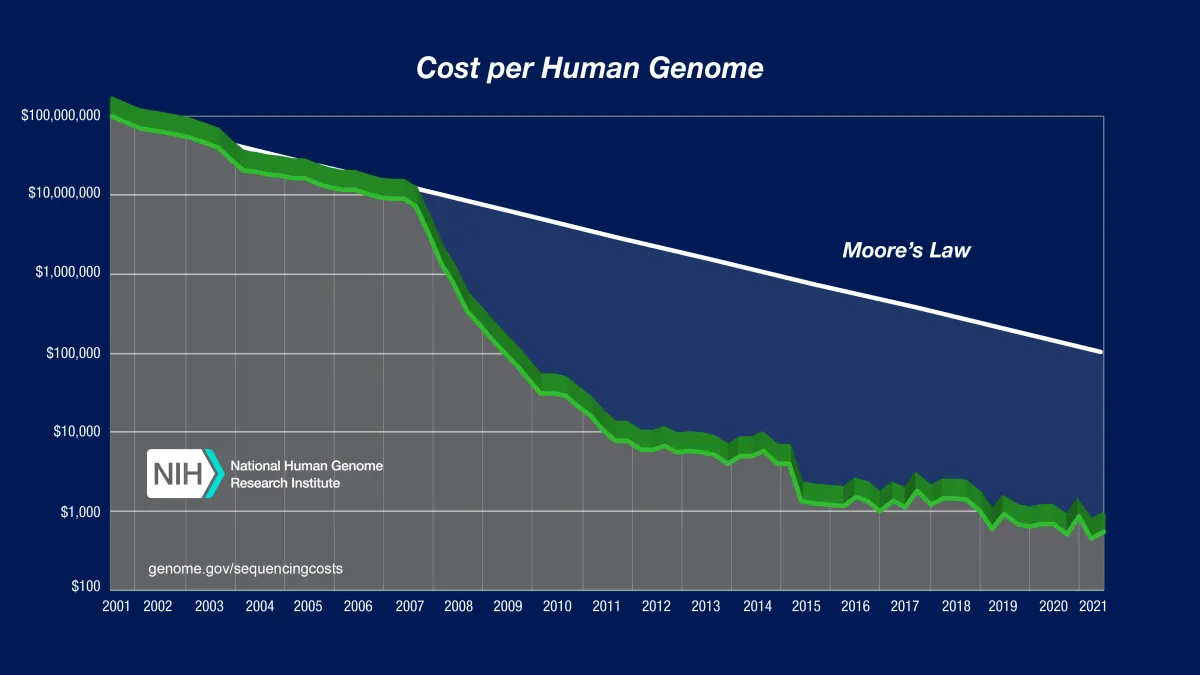

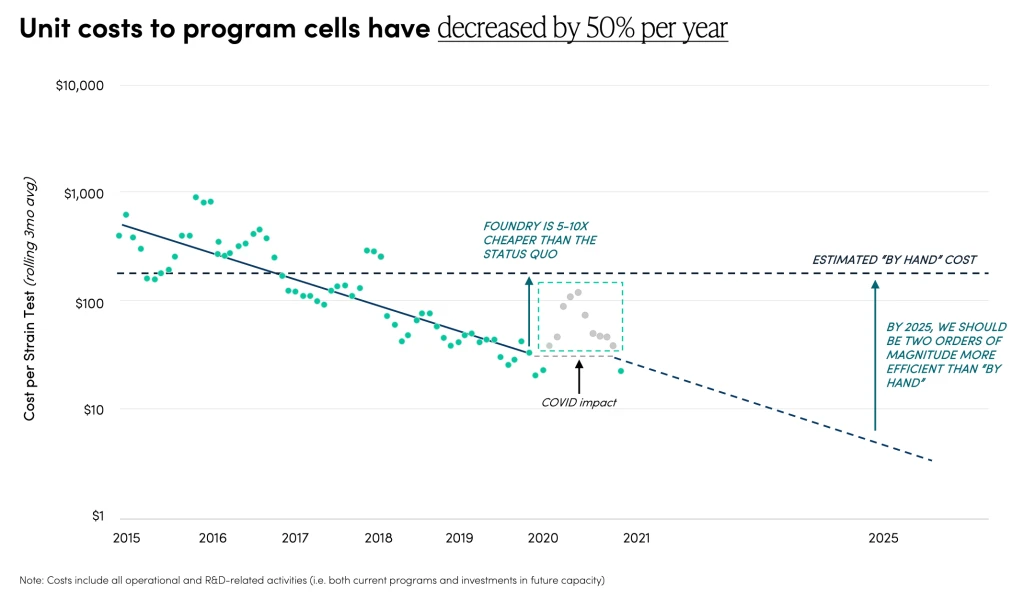

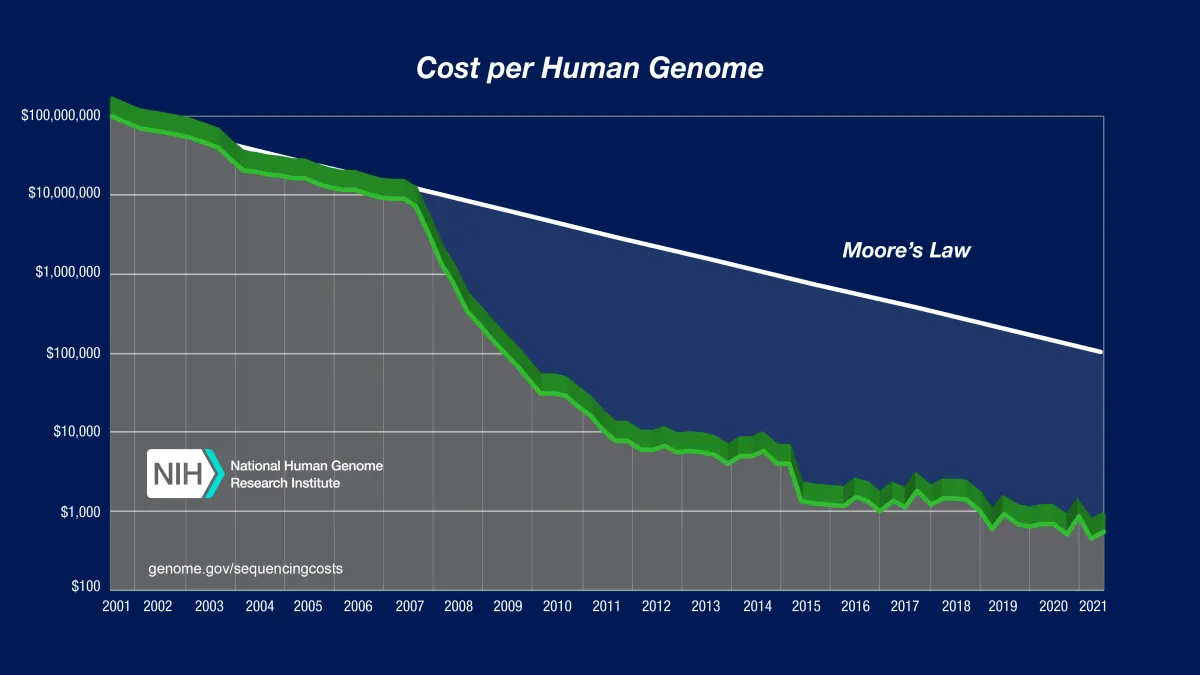

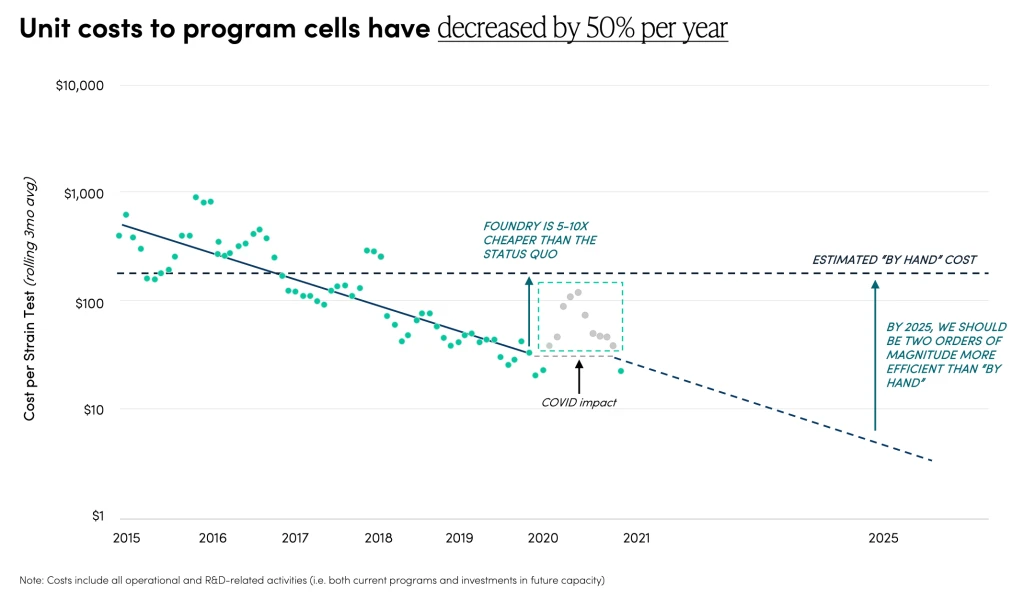

Costs: 📉

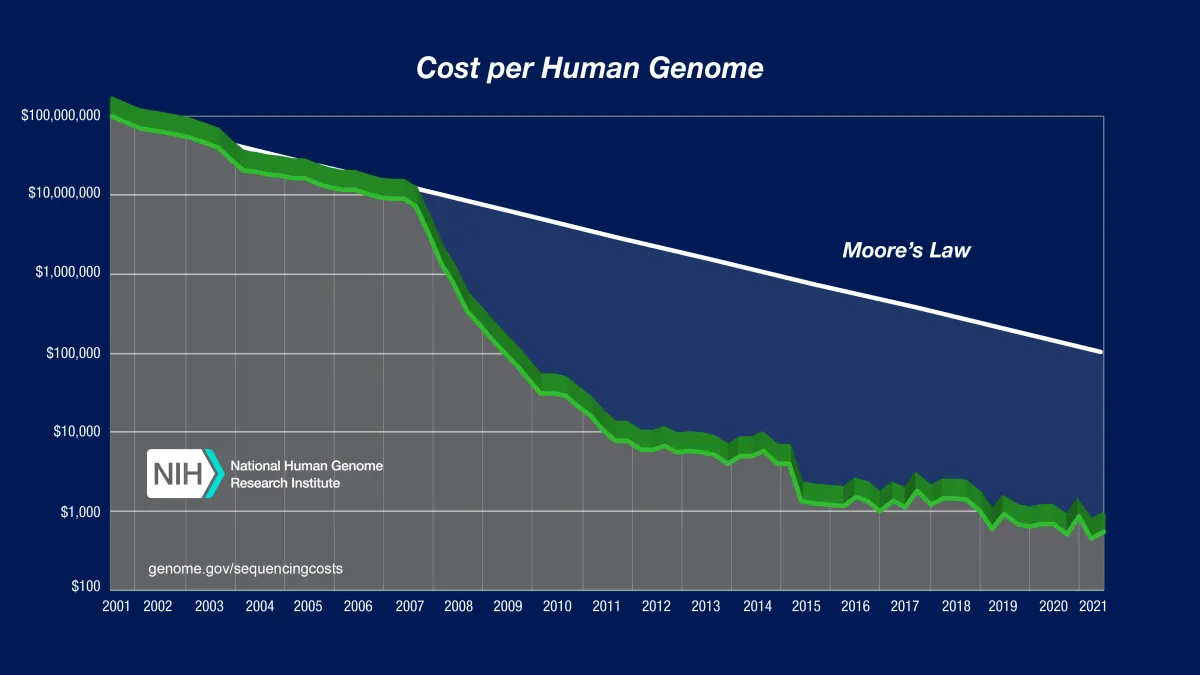

Science is getting cheaper.

Genomic sequencing costs have been dropping faster than Moore’s Law for more than a decade.

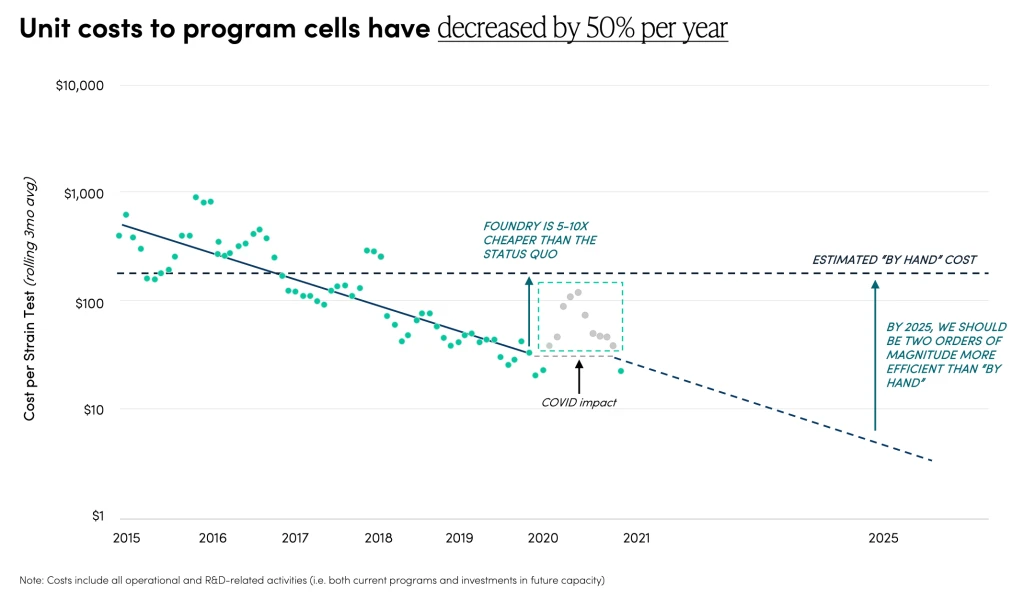

Cell programming costs are also decreasing logarithmically. Biology is now programmable.

AI and ML tools are allowing scientists to discover and test more solutions entirely in silico.

Source: The Cost of Sequencing a Human Genome – NIH

Source: May 2021 Investor Presentation – Ginkgo Bioworks

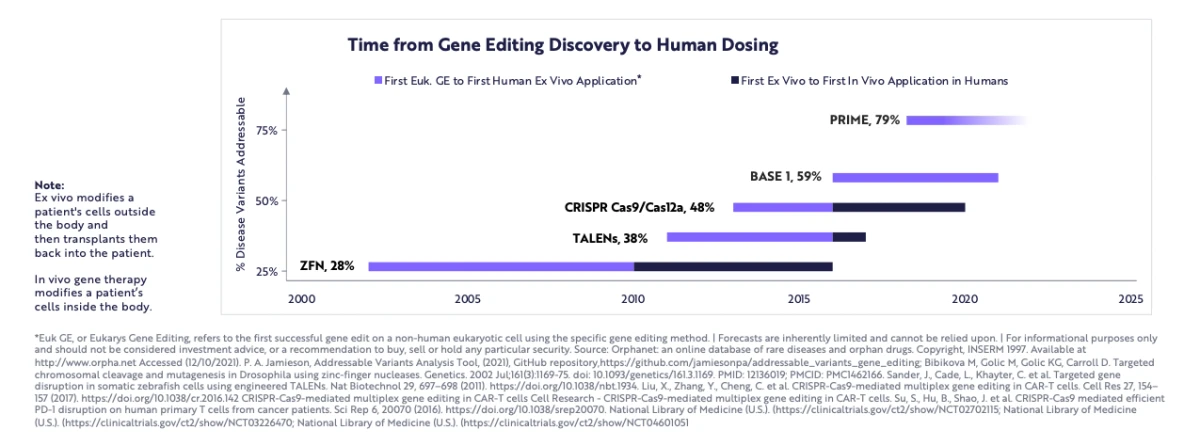

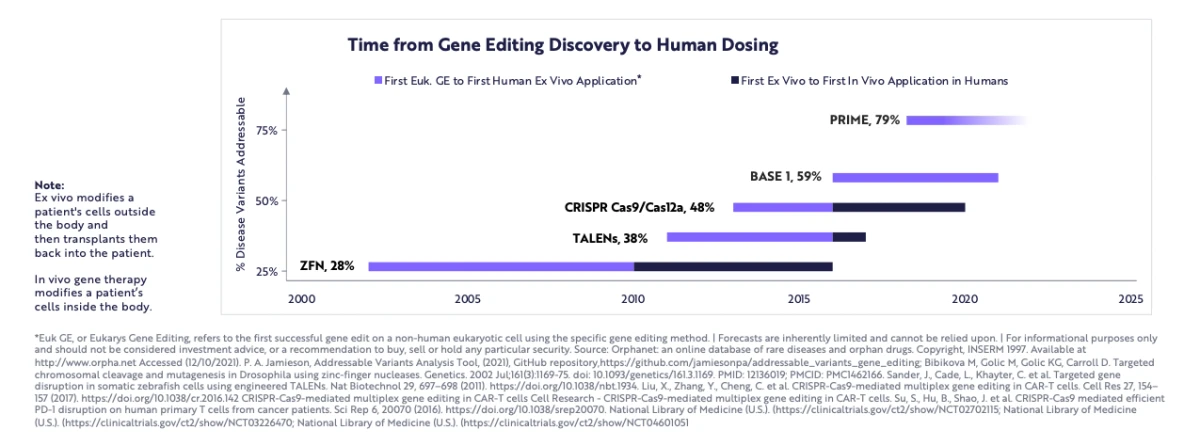

Speed: 📈

Science is getting faster.

In 2020, we had the first Big Bang moment in biotech. Scientists went from discovery of a novel coronavirus to full sequencing of the virus and design of the first COVID vaccine in four days total.

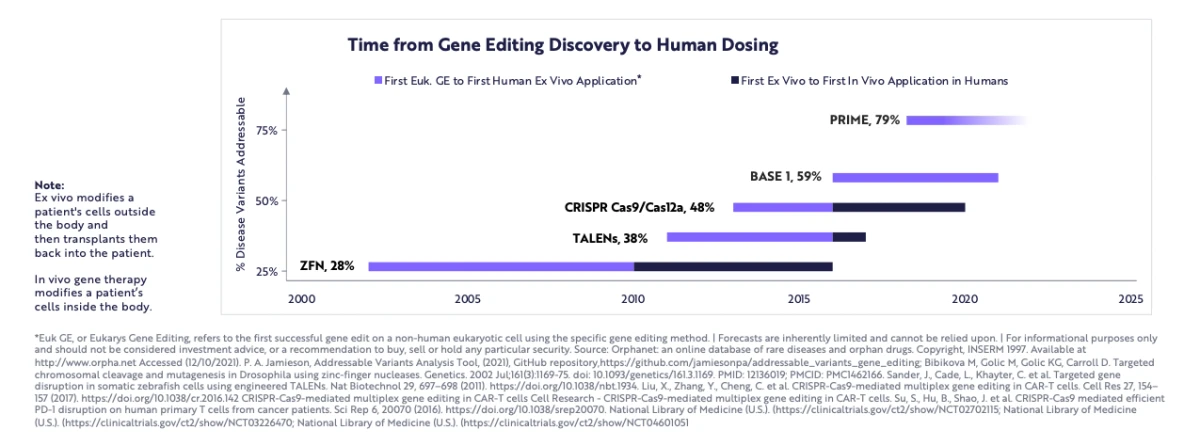

CRISPR moved from discovery to first human dose in three years (2013-2016).

Zinc Finger nucleases (ZFNs) did the same in eight years (2002-2010).

Prime and Base editing are expected to outperform CRISPR in human dosing by 2025.

Source: ARK Invest Big Ideas 2022

Regulations: 📉

VCs can now get the upside of biotech without the costs of pharma. Biotech startups with simple paths to prototypes and low regulatory burden can demonstrate their technology works for <$100K (vs. $4M for pharma Phase I) and get to market for <$100M (vs. $2B for pharma GTM).

Regulatory institutions are now opening special pathways for breakthrough technologies. New emergency use authorization (EUA) and breakthrough therapy pathways at the FDA are now expediting the development of new treatments.

Micro VC funds should target non-regulated biotech startups. It’s assumed that each biotech startup will require hundreds of millions of dollars in funding to be successful due to FDA regulations. But many biotech startups operate in non-regulated fields like materials science that do not have these regulatory risks or costs.

Incumbents: 📉

Larger funds are now focusing on bio + health seed and Series A deals. There is still a lot of demand for micro VCs to write angel and pre-seed checks before these funds invest.

Top Biotech Accelerators: Y Combinator, IndieBio (SOSV), Petri (Pillar)

“Today, YC funds more biotech startups each year than any other investor.”

Top Biotech Seed Funds: Artis Ventures, Fifty Years, Cantos, Refactor, Longevity Fund

These funds write $500K-3M seed checks to biotech and deep tech startups.

Top $B+ Funds That Write Biotech Seed Checks: Khosla Ventures, Lux Capital, a16z, Founders Fund

These name-brand VC funds can be quick to write $100K-500K seed checks, but founders risk negative signaling if the same fund doesn’t quickly lead the Series A.

Opportunity: 📈

Invest the first $50K-250K in scientific startups that are promising but too early for YC. New biotech and deep tech founders need help dropping out, spinning out, and starting up. More pre-seed VC funds should focus on this sector and stage. (See: Utopic Ventures)

YC has moved one stage later, now writing $500K checks to seed-stage startups. Especially with biotech, YC focuses on companies that already have figured out their business model and regulatory plan.

Biopharma is already the 2nd largest VC sector by total funding (after software). With most software already reaching market saturation, biotech has more potential to expand in the next decade. We are in the early stages of Biotech 1.0.

More angels and VC funds should write smaller checks earlier to more biotech startups. By breaking the first funding round in biotech into more stages, we can fund many more startups and create a founder-friendly ecosystem.

Summary

1. We are in the dot-com era for biotech. 10+ years ago, software was eating the world. Now biology is eating the world. Just like mobile applications became ubiquitous over the last decade, biotech applications in fields like medicine, agriculture, and climate will benefit billions of people in the next decade.

2. Science is getting faster and cheaper, but VCs are still treating all biotech startups like pharma companies. Biotech pre-seed and seed funds should focus on startups that can prototype their invention cheaply (ideally <$100K). VCs should also invest in more non-pharma (e.g. industrial and agricultural) applications.

3. Biotech startups need to follow the YC fundraising model. This means raising money at multiple stages (angel, pre-seed, and seed) prior to Series A, and even breaking these rounds into different valuation tiers based on when investors commit. This strategy gives founders more control and prevents VCs from taking over startups at Series A.

4. We need more micro VCs focused on scientific startups. As the cost of biotech R&D continues to decrease, there will be many more biotech startups formed each year. This is a big opportunity for angel and pre-seed biotech investors who start investing now.

This is Part 2 in a series of essays comparing the new biotech revolution to the current tech revolution.

Part 1 is titled “It’s 1994 Again”, explaining how we are now in the dot-com era for biotech.

Part 3 is titled “Scientist CEOs”, arguing why scientists should run their own companies.

Part 4 is titled “Biotech 2.0”, on how to build and fund the future of biotech.

Part 5 will be titled “The Next Genentech”, on the search for the next great biotech company.

Subscribe to my newsletter to be first to read my new essays, including the rest of this series.

Posted byNeil Thanedar

Bringing the original YC model to biotech.

Introduction:

Right now, there are two dominant models in biotech VC:

Venture Incubators (e.g. Flagship Pioneering – $14B AUM): VCs who create startups like Moderna “in-house”, choose the ideas, and license or build the technology themselves.

Institutional VC Funds (e.g. NEA – $25B AUM, OrbiMed – $21B AUM): VCs who invest in the biggest biotech Series A, B, and C+ rounds.

Both of these VC models are built for the old playbook for biopharma company formation:

Raise $10M+ to set up a lab, team, and infrastructure.

Hire experienced executives with PhDs, MDs, and/or MBAs to run the company.

Raise $100M+ to get through regulatory approval.

Two big changes have made it much cheaper to launch and scale biotech companies:

l.Biotech startups can now create working prototypes for less than $100K.

New industrial, chemical, and climate biotech applications often don’t require regulatory approva

The new playbook for biotech will be the YC fundraising model, as explained by Paul Graham:

“get started with a few tens of thousands from something like Y Combinator or individual angels…

raise a few hundred thousand to a few million to build the company…

once the company is clearly succeeding, raise one or more later rounds to accelerate growth.”

Biotech is stuck on Steps 1 and 2 right now. This means that only biotech founders who can skip to Step 3, usually experienced executives with previous exits, are getting funded.

Scientist-led biotech startups like Ginkgo Bioworks, Recursion, AbCellera, and Solugen continue to demonstrate that scientists-turned-founders can lead multi-billion-dollar startups.

We need more angels and VCs writing pre-seed checks to biotech startups. Bringing the YC model to biotech will lead to the creation of many more biotech startups led by their scientist founder/CEOs.

Problems:

1. The balance of power in biotech still favors investors over founders.

The median biotech company raises $44M Series A at a $83M valuation (57% ownership for VCs).

The median tech company raises $15M Series A at a $65M valuation (23% ownership for VCs).

2. There are not enough pre-seed and seed biotech VC investors. This is forcing scientific founders to rely on time-consuming academic and government grants for their first $10K-1M+ in funding.

3. Biotech VCs are biased against younger and first-time founders. When fundraising is so key to startup success, VCs select for that skill over scientific brilliance.

4. Biotech startups are raising too much money too early. Verily, Calico, and Grail, the three biggest biotech startups this decade with billions in funding each, have each struggled to commercialize any major life-saving technologies. More funding does not equal more, bigger, or faster results.

Solutions:

1. We need to bring the YC fundraising model to biotech. Here are the key steps:

Angel: $50K+ to start the company.

Pre-Seed: $250K+ to create prototype(s).

Seed: $1M+ to scale to production.

Series A: $5M+ to ramp up capacity.

2. We need more angels and micro VC funds in biotech. Three types of investors will fill this gap:

New pre-seed biotech VC funds will launch.

Seed and Series A biotech VCs will move earlier.

Generalist angels and pre-seed VCs will focus more on biotech.

3. Biotech VCs need to invest in more young scientific CEOs. Bob Swanson, founding CEO of Genentech, and Michael Riordan, founding CEO of Gilead, were both 29 years old when they started their companies. Both companies now do $20B+ a year in revenues and are each worth $100B+.

4. Biotech startups need to operate like YC companies. The YC fundraising model requires founders to hit more milestones faster so they can raise money more frequently on better terms. This helps biotech founders keep control of their companies and focuses startups on consistently delivering results.

History:

VCs in Silicon Valley used to operate like biotech VCs do now. 20+ years ago, it cost $5M+ to buy and operate a tech company’s hardware. So the first funding round was usually a $5M+ Series A where VCs controlled the board and had the right to fire founders.

Three key developments created a booming tech seed funding market:

Tech hardware got replaced by cloud services, dropping the cost of starting a startup to <$100K.

Y Combinator was created in 2005 and has now funded over 3,000 startups.

Hundreds of institutional seed funds formed to invest before, during, and after YC.

This led to a revolution in how tech founders fundraise for and operate their startups. Because founders could raise from YC and seed funds, they didn’t have to give up control to VCs at Series A.

Founder control is now standard in Silicon Valley. Y Combinator’s top companies Stripe, Airbnb, Doordash, Coinbase, and Dropbox are all still run by their founding CEO.

Trends:

1. There is a funding gap for pre-seed scientific startups.

Over 75% of all life sciences funding is distributed via academic and/or government grants.

Another 20%+ ($15B per year) is invested by institutional VCs, PEs, and corporates.

This leaves less than $3B per year in seed funding (<5%) for all biotech + medtech startups.

Source: Bridging the ‘Valley of Death’ for U.S. Biomanufacturing

2. More venture capital funds are flowing to fewer companies.

This trend is driven by increasing VC fund sizes.

VC assets under management (AUM) has grown 5X+ (20.2% CAGR) since 2012.

The total number of active US VC funds only grew from 750 to 1,000 since 2010.

This dynamic leads to higher fees but lower returns.

VC fund models show that larger portfolios outperform smaller ones from 10 to 1000 startups.

Source: The Future of Biotech is Founder-Led

Costs: 📉

Science is getting cheaper.

Genomic sequencing costs have been dropping faster than Moore’s Law for more than a decade.

Cell programming costs are also decreasing logarithmically. Biology is now programmable.

AI and ML tools are allowing scientists to discover and test more solutions entirely in silico.

Source: The Cost of Sequencing a Human Genome – NIH

Source: May 2021 Investor Presentation – Ginkgo Bioworks

Speed: 📈

Science is getting faster.

In 2020, we had the first Big Bang moment in biotech. Scientists went from discovery of a novel coronavirus to full sequencing of the virus and design of the first COVID vaccine in four days total.

CRISPR moved from discovery to first human dose in three years (2013-2016).

Zinc Finger nucleases (ZFNs) did the same in eight years (2002-2010).

Prime and Base editing are expected to outperform CRISPR in human dosing by 2025.

Source: ARK Invest Big Ideas 2022

Regulations: 📉

VCs can now get the upside of biotech without the costs of pharma. Biotech startups with simple paths to prototypes and low regulatory burden can demonstrate their technology works for <$100K (vs. $4M for pharma Phase I) and get to market for <$100M (vs. $2B for pharma GTM).

Regulatory institutions are now opening special pathways for breakthrough technologies. New emergency use authorization (EUA) and breakthrough therapy pathways at the FDA are now expediting the development of new treatments.

Micro VC funds should target non-regulated biotech startups. It’s assumed that each biotech startup will require hundreds of millions of dollars in funding to be successful due to FDA regulations. But many biotech startups operate in non-regulated fields like materials science that do not have these regulatory risks or costs.

Incumbents: 📉

Larger funds are now focusing on bio + health seed and Series A deals. There is still a lot of demand for micro VCs to write angel and pre-seed checks before these funds invest.

Top Biotech Accelerators: Y Combinator, IndieBio (SOSV), Petri (Pillar)

“Today, YC funds more biotech startups each year than any other investor.”

Top Biotech Seed Funds: Artis Ventures, Fifty Years, Cantos, Refactor, Longevity Fund

These funds write $500K-3M seed checks to biotech and deep tech startups.

Top $B+ Funds That Write Biotech Seed Checks: Khosla Ventures, Lux Capital, a16z, Founders Fund

These name-brand VC funds can be quick to write $100K-500K seed checks, but founders risk negative signaling if the same fund doesn’t quickly lead the Series A.

Opportunity: 📈

Invest the first $50K-250K in scientific startups that are promising but too early for YC. New biotech and deep tech founders need help dropping out, spinning out, and starting up. More pre-seed VC funds should focus on this sector and stage. (See: Utopic Ventures)

YC has moved one stage later, now writing $500K checks to seed-stage startups. Especially with biotech, YC focuses on companies that already have figured out their business model and regulatory plan.

Biopharma is already the 2nd largest VC sector by total funding (after software). With most software already reaching market saturation, biotech has more potential to expand in the next decade. We are in the early stages of Biotech 1.0.

More angels and VC funds should write smaller checks earlier to more biotech startups. By breaking the first funding round in biotech into more stages, we can fund many more startups and create a founder-friendly ecosystem.

Summary

1. We are in the dot-com era for biotech. 10+ years ago, software was eating the world. Now biology is eating the world. Just like mobile applications became ubiquitous over the last decade, biotech applications in fields like medicine, agriculture, and climate will benefit billions of people in the next decade.

2. Science is getting faster and cheaper, but VCs are still treating all biotech startups like pharma companies. Biotech pre-seed and seed funds should focus on startups that can prototype their invention cheaply (ideally <$100K). VCs should also invest in more non-pharma (e.g. industrial and agricultural) applications.

3. Biotech startups need to follow the YC fundraising model. This means raising money at multiple stages (angel, pre-seed, and seed) prior to Series A, and even breaking these rounds into different valuation tiers based on when investors commit. This strategy gives founders more control and prevents VCs from taking over startups at Series A.

4. We need more micro VCs focused on scientific startups. As the cost of biotech R&D continues to decrease, there will be many more biotech startups formed each year. This is a big opportunity for angel and pre-seed biotech investors who start investing now.

This is Part 2 in a series of essays comparing the new biotech revolution to the current tech revolution.

Part 1 is titled “It’s 1994 Again”, explaining how we are now in the dot-com era for biotech.

Part 3 is titled “Scientist CEOs”, arguing why scientists should run their own companies.

Part 4 is titled “Biotech 2.0”, on how to build and fund the future of biotech.

Part 5 will be titled “The Next Genentech”, on the search for the next great biotech company.

Subscribe to my newsletter to be first to read my new essays, including the rest of this series.

Posted byNeil Thanedar

Bringing the original YC model to biotech.

Introduction:

Right now, there are two dominant models in biotech VC:

Venture Incubators (e.g. Flagship Pioneering – $14B AUM): VCs who create startups like Moderna “in-house”, choose the ideas, and license or build the technology themselves.

Institutional VC Funds (e.g. NEA – $25B AUM, OrbiMed – $21B AUM): VCs who invest in the biggest biotech Series A, B, and C+ rounds.

Both of these VC models are built for the old playbook for biopharma company formation:

Raise $10M+ to set up a lab, team, and infrastructure.

Hire experienced executives with PhDs, MDs, and/or MBAs to run the company.

Raise $100M+ to get through regulatory approval.

Two big changes have made it much cheaper to launch and scale biotech companies:

l.Biotech startups can now create working prototypes for less than $100K.

New industrial, chemical, and climate biotech applications often don’t require regulatory approva

The new playbook for biotech will be the YC fundraising model, as explained by Paul Graham:

“get started with a few tens of thousands from something like Y Combinator or individual angels…

raise a few hundred thousand to a few million to build the company…

once the company is clearly succeeding, raise one or more later rounds to accelerate growth.”

Biotech is stuck on Steps 1 and 2 right now. This means that only biotech founders who can skip to Step 3, usually experienced executives with previous exits, are getting funded.

Scientist-led biotech startups like Ginkgo Bioworks, Recursion, AbCellera, and Solugen continue to demonstrate that scientists-turned-founders can lead multi-billion-dollar startups.

We need more angels and VCs writing pre-seed checks to biotech startups. Bringing the YC model to biotech will lead to the creation of many more biotech startups led by their scientist founder/CEOs.

Problems:

1. The balance of power in biotech still favors investors over founders.

The median biotech company raises $44M Series A at a $83M valuation (57% ownership for VCs).

The median tech company raises $15M Series A at a $65M valuation (23% ownership for VCs).

2. There are not enough pre-seed and seed biotech VC investors. This is forcing scientific founders to rely on time-consuming academic and government grants for their first $10K-1M+ in funding.

3. Biotech VCs are biased against younger and first-time founders. When fundraising is so key to startup success, VCs select for that skill over scientific brilliance.

4. Biotech startups are raising too much money too early. Verily, Calico, and Grail, the three biggest biotech startups this decade with billions in funding each, have each struggled to commercialize any major life-saving technologies. More funding does not equal more, bigger, or faster results.

Solutions:

1. We need to bring the YC fundraising model to biotech. Here are the key steps:

Angel: $50K+ to start the company.

Pre-Seed: $250K+ to create prototype(s).

Seed: $1M+ to scale to production.

Series A: $5M+ to ramp up capacity.

2. We need more angels and micro VC funds in biotech. Three types of investors will fill this gap:

New pre-seed biotech VC funds will launch.

Seed and Series A biotech VCs will move earlier.

Generalist angels and pre-seed VCs will focus more on biotech.

3. Biotech VCs need to invest in more young scientific CEOs. Bob Swanson, founding CEO of Genentech, and Michael Riordan, founding CEO of Gilead, were both 29 years old when they started their companies. Both companies now do $20B+ a year in revenues and are each worth $100B+.

4. Biotech startups need to operate like YC companies. The YC fundraising model requires founders to hit more milestones faster so they can raise money more frequently on better terms. This helps biotech founders keep control of their companies and focuses startups on consistently delivering results.

History:

VCs in Silicon Valley used to operate like biotech VCs do now. 20+ years ago, it cost $5M+ to buy and operate a tech company’s hardware. So the first funding round was usually a $5M+ Series A where VCs controlled the board and had the right to fire founders.

Three key developments created a booming tech seed funding market:

Tech hardware got replaced by cloud services, dropping the cost of starting a startup to <$100K.

Y Combinator was created in 2005 and has now funded over 3,000 startups.

Hundreds of institutional seed funds formed to invest before, during, and after YC.

This led to a revolution in how tech founders fundraise for and operate their startups. Because founders could raise from YC and seed funds, they didn’t have to give up control to VCs at Series A.

Founder control is now standard in Silicon Valley. Y Combinator’s top companies Stripe, Airbnb, Doordash, Coinbase, and Dropbox are all still run by their founding CEO.

Trends:

1. There is a funding gap for pre-seed scientific startups.

Over 75% of all life sciences funding is distributed via academic and/or government grants.

Another 20%+ ($15B per year) is invested by institutional VCs, PEs, and corporates.

This leaves less than $3B per year in seed funding (<5%) for all biotech + medtech startups.

Source: Bridging the ‘Valley of Death’ for U.S. Biomanufacturing

2. More venture capital funds are flowing to fewer companies.

This trend is driven by increasing VC fund sizes.

VC assets under management (AUM) has grown 5X+ (20.2% CAGR) since 2012.

The total number of active US VC funds only grew from 750 to 1,000 since 2010.

This dynamic leads to higher fees but lower returns.

VC fund models show that larger portfolios outperform smaller ones from 10 to 1000 startups.

Source: The Future of Biotech is Founder-Led

Costs: 📉

Science is getting cheaper.

Genomic sequencing costs have been dropping faster than Moore’s Law for more than a decade.

Cell programming costs are also decreasing logarithmically. Biology is now programmable.

AI and ML tools are allowing scientists to discover and test more solutions entirely in silico.

Source: The Cost of Sequencing a Human Genome – NIH

Source: May 2021 Investor Presentation – Ginkgo Bioworks

Speed: 📈

Science is getting faster.

In 2020, we had the first Big Bang moment in biotech. Scientists went from discovery of a novel coronavirus to full sequencing of the virus and design of the first COVID vaccine in four days total.

CRISPR moved from discovery to first human dose in three years (2013-2016).

Zinc Finger nucleases (ZFNs) did the same in eight years (2002-2010).

Prime and Base editing are expected to outperform CRISPR in human dosing by 2025.

Source: ARK Invest Big Ideas 2022

Regulations: 📉

VCs can now get the upside of biotech without the costs of pharma. Biotech startups with simple paths to prototypes and low regulatory burden can demonstrate their technology works for <$100K (vs. $4M for pharma Phase I) and get to market for <$100M (vs. $2B for pharma GTM).

Regulatory institutions are now opening special pathways for breakthrough technologies. New emergency use authorization (EUA) and breakthrough therapy pathways at the FDA are now expediting the development of new treatments.

Micro VC funds should target non-regulated biotech startups. It’s assumed that each biotech startup will require hundreds of millions of dollars in funding to be successful due to FDA regulations. But many biotech startups operate in non-regulated fields like materials science that do not have these regulatory risks or costs.

Incumbents: 📉

Larger funds are now focusing on bio + health seed and Series A deals. There is still a lot of demand for micro VCs to write angel and pre-seed checks before these funds invest.

Top Biotech Accelerators: Y Combinator, IndieBio (SOSV), Petri (Pillar)

“Today, YC funds more biotech startups each year than any other investor.”

Top Biotech Seed Funds: Artis Ventures, Fifty Years, Cantos, Refactor, Longevity Fund

These funds write $500K-3M seed checks to biotech and deep tech startups.

Top $B+ Funds That Write Biotech Seed Checks: Khosla Ventures, Lux Capital, a16z, Founders Fund

These name-brand VC funds can be quick to write $100K-500K seed checks, but founders risk negative signaling if the same fund doesn’t quickly lead the Series A.

Opportunity: 📈

Invest the first $50K-250K in scientific startups that are promising but too early for YC. New biotech and deep tech founders need help dropping out, spinning out, and starting up. More pre-seed VC funds should focus on this sector and stage. (See: Utopic Ventures)

YC has moved one stage later, now writing $500K checks to seed-stage startups. Especially with biotech, YC focuses on companies that already have figured out their business model and regulatory plan.

Biopharma is already the 2nd largest VC sector by total funding (after software). With most software already reaching market saturation, biotech has more potential to expand in the next decade. We are in the early stages of Biotech 1.0.

More angels and VC funds should write smaller checks earlier to more biotech startups. By breaking the first funding round in biotech into more stages, we can fund many more startups and create a founder-friendly ecosystem.

Summary

1. We are in the dot-com era for biotech. 10+ years ago, software was eating the world. Now biology is eating the world. Just like mobile applications became ubiquitous over the last decade, biotech applications in fields like medicine, agriculture, and climate will benefit billions of people in the next decade.

2. Science is getting faster and cheaper, but VCs are still treating all biotech startups like pharma companies. Biotech pre-seed and seed funds should focus on startups that can prototype their invention cheaply (ideally <$100K). VCs should also invest in more non-pharma (e.g. industrial and agricultural) applications.

3. Biotech startups need to follow the YC fundraising model. This means raising money at multiple stages (angel, pre-seed, and seed) prior to Series A, and even breaking these rounds into different valuation tiers based on when investors commit. This strategy gives founders more control and prevents VCs from taking over startups at Series A.

4. We need more micro VCs focused on scientific startups. As the cost of biotech R&D continues to decrease, there will be many more biotech startups formed each year. This is a big opportunity for angel and pre-seed biotech investors who start investing now.

This is Part 2 in a series of essays comparing the new biotech revolution to the current tech revolution.

Part 1 is titled “It’s 1994 Again”, explaining how we are now in the dot-com era for biotech.

Part 3 is titled “Scientist CEOs”, arguing why scientists should run their own companies.

Part 4 is titled “Biotech 2.0”, on how to build and fund the future of biotech.

Part 5 will be titled “The Next Genentech”, on the search for the next great biotech company.

Subscribe to my newsletter to be first to read my new essays, including the rest of this series.

For forward-thinking industry leaders,

founders, corporations, and governments.

Let's work together.

For forward-thinking industry leaders,

founders, corporations, and governments.

Let's work together.